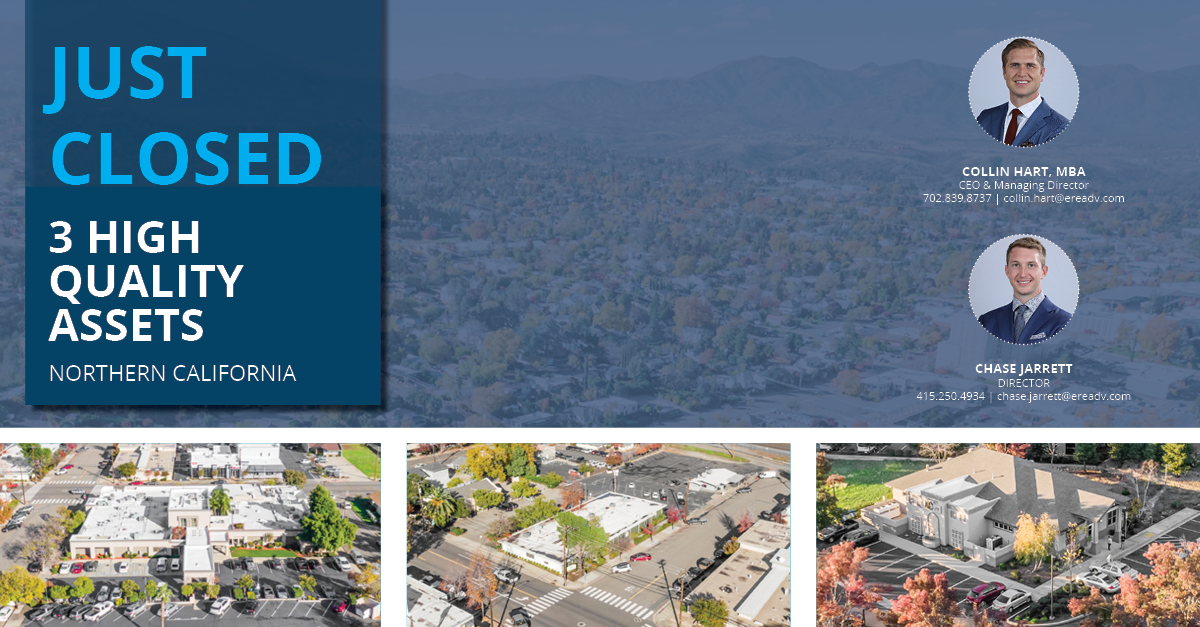

ERE Healthcare Real Estate Advisors (“ERE”) is pleased to announce the successful sale of 3 high quality assets in Northern California that were monetized with the goal of divesting the real estate interest of our physician clients. The dominant imaging group consisted of 11 physician partners in the practice, and 12 partners in the real estate. There was some potential misalignment in interests on the horizon concerning retiring physicians who want to monetize and younger physicians looking to grow the practice and incentivize recruitment through a reasonable rental rate, familiar lease terms, and eliminating a power imbalance.

ERE was engaged to explore a sale and leaseback with a specific focus on maintaining a manageable overhead for future partners joining the practice. Leveraging a thorough understanding of the financial impact of varying retirement timelines, ERE structured lease terms to achieve objectives of the practice, while unlocking value and separating interest of the real estate partners through effectuating a sale of their 3-property portfolio. With a properly structured lease, ERE identified the most aggressive prospective buyers, ultimately guiding the physician partnership and their counsel through a successful transaction.

After orchestrating a competitive bidding process and generating 7 qualified offers, ERE leveraged multiple buyers to create maximized value on behalf of the client.

The transaction was led by Collin Hart and Chase Jarrett.