Physician Owned Real Estate: Florida Poised to Prosper in 2022

By: Andy Matti, Associate, ERE Healthcare Real Estate Advisors

By: Andy Matti, Associate, ERE Healthcare Real Estate Advisors

Florida, a state once recognized as a haven for retirees and part-time residents, is now attracting new full-time residents from across the country. In the 12 months ending July 2021, Florida experienced exponential growth, adding over 200,000 new residents, second only to Texas. No state income tax, desirable weather, plentiful amenities, and remote work opportunities have contributed to this new wave of migration.

Real estate investors took note and have made the sunshine state a top destination to deploy capital, diversify their portfolios, and ride the wave of growth. In particular, demand for healthcare real estate is expected to reach new highs in 2022. This trend uniquely positions physicians who own their real estate to capitalize on unprecedented values.

Historically, many physicians develop their own facility because it allows them to control the destiny of their practice, manage their occupancy cost, and become a real estate investor. Our firm frequently encounters physicians focused solely on the benefits of flexibility, pride of ownership, and long-term monthly cash flow. Yet surprisingly, many haven’t determined the long-term strategy for one of their largest investments.

Over the next decade many physicians will look towards retirement. With 60% of physicians over the age of 50, near term turnover is imminent. More specifically, 34% of physicians are still practicing past the age of 60. The concentration of physicians over 50 is even higher amongst specialists, including Orthopods (52%), Urologists (48%), and Ophthalmologists (48%). Considering 75% of physician-owned practices have between one and 20 providers, physician turnover can have a major impact on a practice. But what does that mean for the real estate?

In most businesses, owners have a tendency to maintain an equity position in the business post-retirement. In contrast, if a physician retires, his ownership in the business is liquidated and redistributed to existing or incoming partners. This is where real estate considerations also come into play. The question arises as to how should a retiring physician’s real estate interest be liquidated?

The reality is, there are limited options. By way of example, If a health system buys a physician’s practice, they have little interest in buying the real estate. If a junior physician joins a practice, they may not have the financial capability or desire to buy into the real estate, especially with medical school debt at an all-time high.

With consideration of the above, let’s assume a physician’s primary option post-retirement is to hold their real estate interests as an investment vehicle for long term cash-flow. This seems a feasible option to most physician groups; who doesn’t want to enjoy long-term passive income? Yet, in the word “long-term” lays the inherent contradiction. The reality is that interests are no longer aligned; the real estate and practice partnerships consist of different partners. As such, the real estate owner is no longer in control of their tenant, resulting in their cash flow being at risk. The practice may continue to operate in the same location, but likely under a short-term lease to maintain flexibility. If the practice relocated to a new building, the ownership is stuck trying to liquidate a large, outdated, special-purpose facility. Most traditional office users don’t require a 20,000 square foot space with a large waiting area and layout suited to delivering healthcare services.

In Florida, the current average sale price for vacant medical office buildings between 10,000 and 50,000 square feet is $173 per square foot, and that’s after being on the market for an average of nine months. Finding the right user can be like finding a needle in a haystack. Even once a buyer is identified, the ownership group could be lucky to break-even, depending on how much they’ve spent on improvements over the years. In contrast, the average value of medical office properties structured as investment sales ranges from $430 to $500 per square foot.

Based on the data, it’s apparent that the best time to sell healthcare real estate is while the practice remains operating within, thus positioning it as an investment sale. For owner occupiers like physician practices, this transaction is known as a sale and leaseback and is simply a real estate sale simultaneous with executing a new long-term lease. In this type of transaction, the real estate is often sold to a third-party institutional investor seeking a stream of consistent rental cashflow. Instead of paying rent from one pocket to another (practice partnership to real estate partnership), the practice now pays rent to a third-party landlord and continues operating, uninterrupted.

At first, a sale and leaseback may sound like a reverse mortgage or a loan. While it’s not quite that, it’s certainly an alternative finance structure. These sales are commonly used by larger corporations as a method to free up capital for investment in other areas, without being recognized as a liability on their balance sheet. However, for many physician-owned practices, this model can be used strategically. A sale and leaseback provides physicians the opportunity to cash out of their real estate at a peak in the market. At the same time, a well-executed sale solves challenges related to partnership structuring, recruitment, turnover, and succession planning. As mentioned above, demand for healthcare real estate investments is on the rise. With fierce market competition, these transactions can be structured with limited personal liability, providing flexibility for partners to be recruited or retire during the term of the lease.

Collin Hart, CEO & Managing Director of ERE Healthcare Real Estate Advisors points out, “Even if a real estate sale doesn’t meet the ownership’s current objectives, addressing potential partnership challenges early will maximize the value and security of their investment.”

Over the last few decades, owning a medical facility has given physicians flexibility; however, divesting the real estate can create opportunities for the future.

Advisory Approach, Expertly Positioning Our Clients

With shifting dynamics in retail, industrial, and multi-family properties, healthcare real estate remains stable. The US demographic is aging, increasing the need for healthcare services. Even with telemedicine, physicians and health systems can’t perform procedures remotely. These factors increase the demand for medical office space and bolster interest in healthcare real estate investments. Are you properly capitalizing on the opportunity?

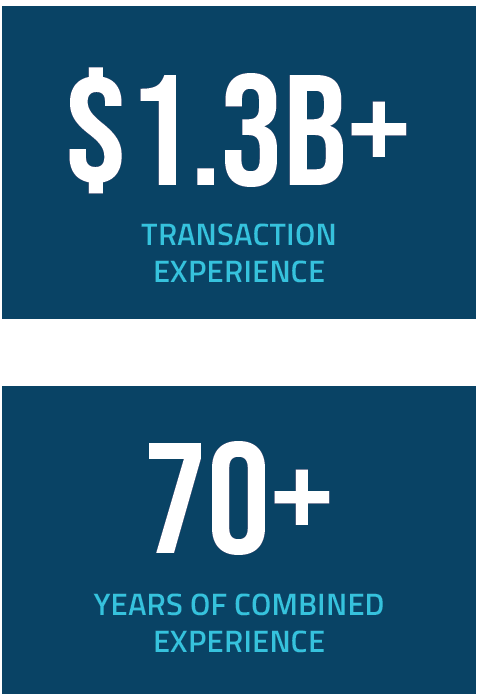

With over 70 years of combined experience, our team has advised on the acquisition and disposition of 187 assets across the United States, representing over $1.3 billion in total consideration.

Through expert guidance in valuation, transaction structuring, marketing and execution, the professionals at ERE can help you achieve exceptional results.